Investing in Litecoin: What to consider

One of the world's top 10 cryptocurrencies, Litecoin (LTC), re-joined the $1 billion market cap club in 2017, after first reaching it in 2013.

Litecoin's infrastructure is very similar to that of Bitcoin and as such, is highly affected by changes in Bitcoin price. Moreover, since it is

relatively smaller than Bitcoin, it still hasn't been adopted by many traders and exchanges. It therefore has great growth potential.

Since it was created originally as an offshoot of Bitcoin, its infrastructure, which includes improvements over that of Bitcoin, has

received praise for its faster processing times and scalability.

WHO SHOULD INCLUDE LITECOIN IN THEIR PORTFOLIOS?

1. Cryptocurrency traders: With an increasing selection of cryptocurrencies available, investing in Litecoin could be a part of a

balanced cryptocurrency portfolio.

2. Currency traders: The use of Litecoin and other cryptocurrencies is becoming increasingly widespread as a hedging tool for

traditional currency traders.

3. Long-term investors: Some analysts predict the cryptocurrency market will continue to grow and increase in value. Therefore,

buying and holding Litecoin might be a good long-term investment.

4. Fintech aficionados: As the cryptocurrency market expands and more governments and institutions legitimise it as a payment

method, Litecoin could increase in popularity and be in higher demand.

WHAT DRIVES LITECOIN'S PRICE

The cryptocurrency market exists in a realm of its own, and is such, is regularly affected by factors from within. Litecoin was created

to be an improved version of Bitcoin, offering faster processing times and a higher number of tokens to eventually be released. While

general trends in the cryptocurrency market could affect LTC alongside other currencies, some other factors can affect it specifically. Three notable influencers are:

1. Bitcoin: Despite no longer being the only player in the industry, Bitcoin is still the benchmark for crypto currencies, and even more

so when it comes to Litecoin, due to the similarity in their blockchain technology. Therefore, LTC prices could be buoyed by rising

Bitcoin prices.

2. Availability: Since cryptocurrencies are bought and sold using various exchanges, and not all services carry all currencies, when a

major exchange adds Litecoin to its offering, it could boost its price.

3. Sudden demand: Sometimes a certain cryptocurrency experiences a surge in demand. This could be the result of press coverage,

a competing currency receiving negative press, or sudden popularity in a new market. For example, in March 2017, Chinese

investors suddenly took an interest in Litecoin, causing its price to rise significantly.

LITECOIN: A BETTER BITCOIN?

In early 2017, there was a major debate in the Bitcoin community regarding a possible hard fork. Essentially, members of the

community were protesting increasingly lower transaction-processing speeds, asking for a change in the underlying blockchain

platform. Conservative members of the community were against this change, and the possibility of Bitcoin splitting into two or more

currencies emerged. However, since Litecoin was created for better scalability, the solution actually came from a solution that was

implemented within the Litecoin code.

Litecoin added a mechanism called SegWit, which, in the simplest of terms, makes the Bitcoin blockchain faster. SegWit enables more

data-per-block to be processed at a given time, accelerating transaction speeds. Key members of the Bitcoin community have said

that SegWit is the solution that will prevent the hard fork and prevent the Bitcoin split, giving Litecoin a seal of approval.

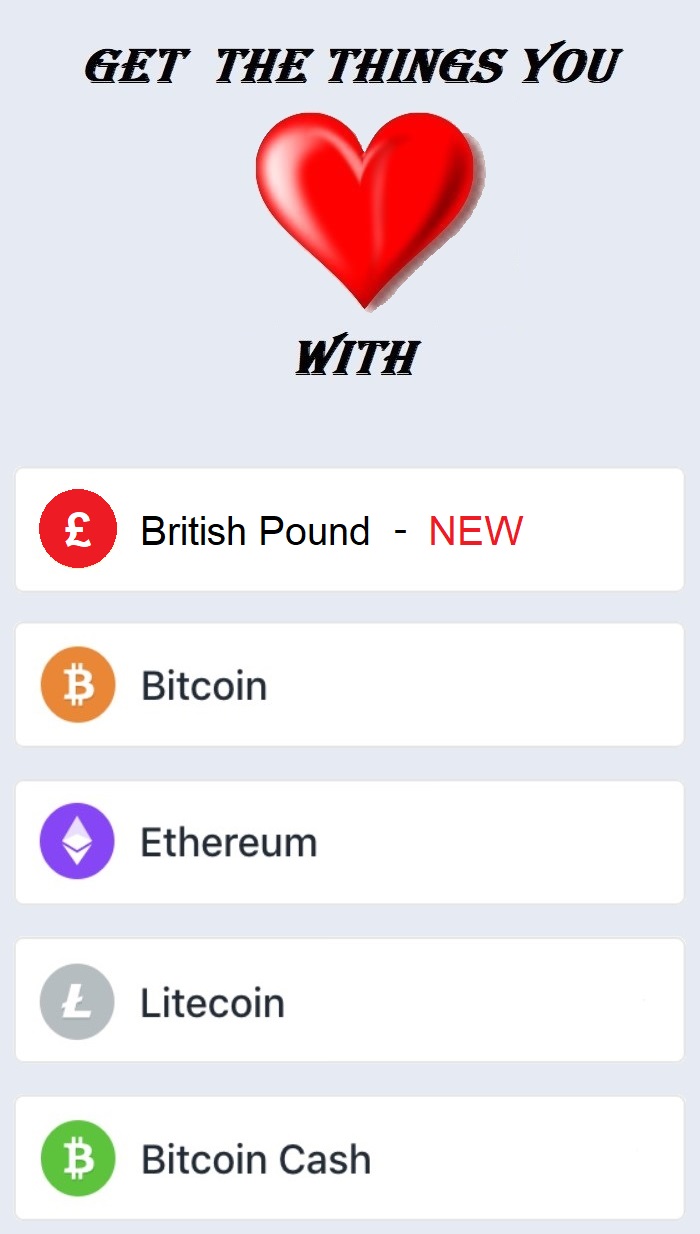

If you still do not have Litecoin you can get some

Here or any of the many other

cryptocurrencies available.